Financial statement

Report to the Federal Council

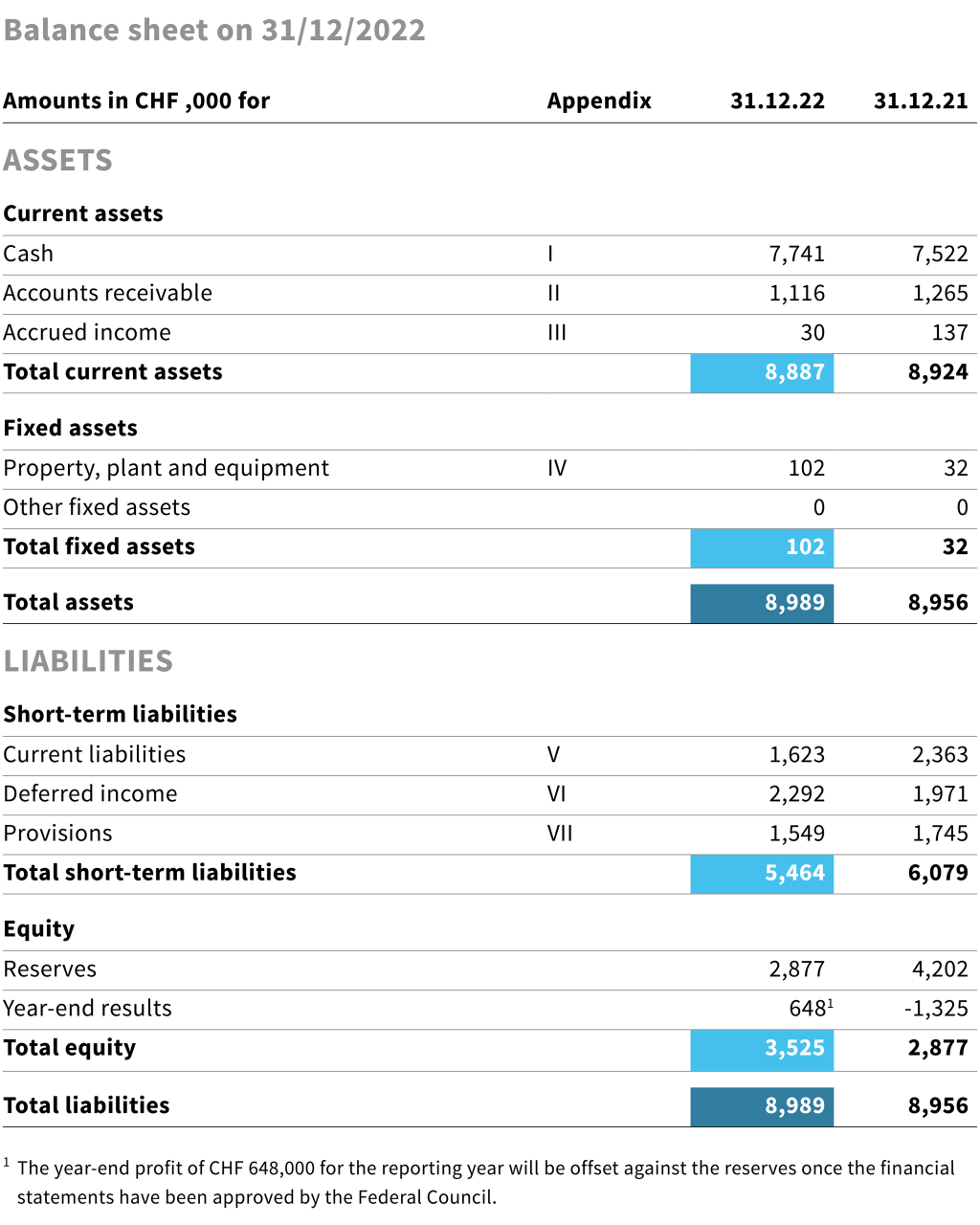

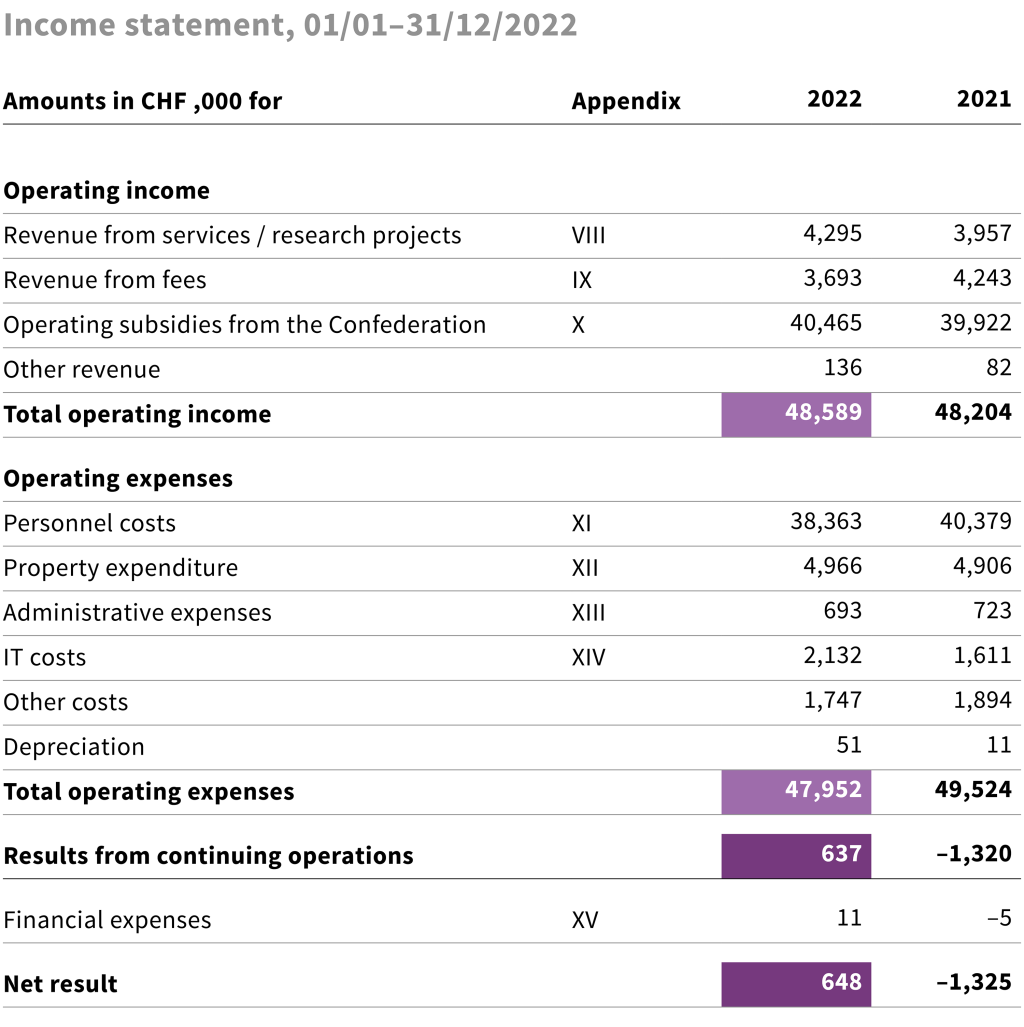

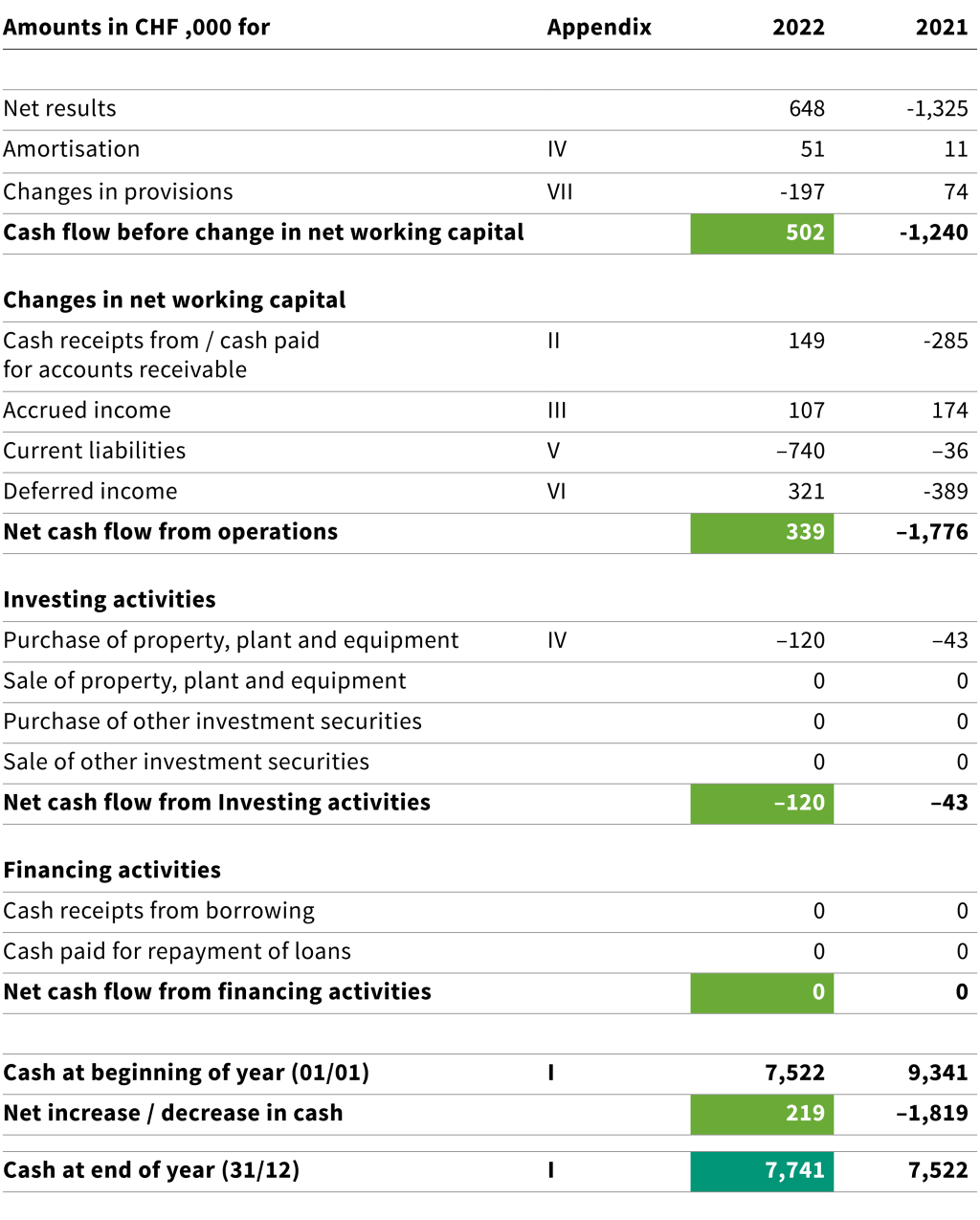

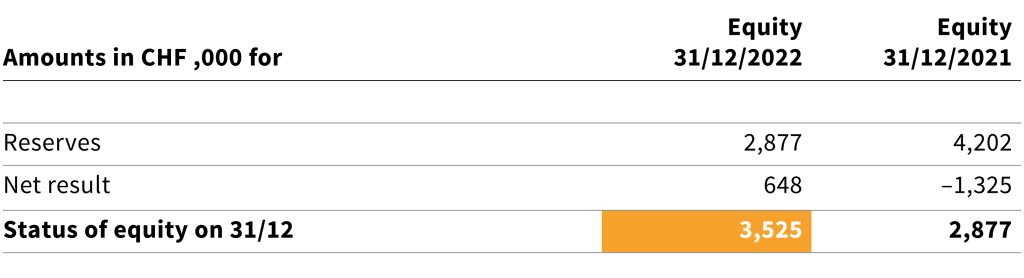

SFUVET’s 2022 Financial Statement closed with a year-end profit of CHF 648,000 based on an operating income of CHF 48,600,000 and operating expenses of CHF 47,952,000. The year-end loss from the previous reporting year stood at CHF 1,325,000. This result is mainly attributable to staff reductions, but also to lower accruals for annual leave and flexitime credits. In addition, lower costs were incurred for external lecturers and project partners, and employer’s contribution reserves were reduced. The higher IT costs resulted from replacement purchases and higher expenditure for external services.

According to Article 24 of the Federal Act of 25 September 2020 on the Swiss Federal University for Vocational Education and Training (SFUVET Act, SR 412.106; status on 1 January 2022), SFUVET may build up reserves, which may not exceed the equivalent of 10% of the operational result reported in the financial statement for the given reporting year.

Reserves are used to offset losses as well as to finance projects and planned capital expenditure.

5. Appendix to Financial Statement

5.1 General information

The Swiss Federal Institute for Vocational Education and Training SFIVET has been renamed the Swiss Federal University for Vocational Education and Training SFUVET. The legal basis for this came into effect on 1 August 2021. As before, SFUVET is a federal institution under public law with its own legal personality (Art. 1 SFUVET Act) and registered office in Zollikofen (Art. 1 of the Ordinance of 18 June 2021 on the Swiss Federal University for Vocational Education and Training, SFUVET Ordinance; SR 412.106; status on 1 August 2022).

According to Art. 29 of the SFUVET Act, the Federal Council establishes SFUVET’s strategic objectives. On 11 December 2020, the Federal Council adopted the strategic objectives to be pursued by the SFUVET Board for 2021–2024.

5.2 General information about SFUVET

Legal form | Public institution with its own legal personality |

Activities | SFUVET is the Confederation’s competence centre for teaching and research in vocational pedagogy, upper-secondary-level vocational education and training, tertiary-level professional education and the cyclical review and revision of the training content of VET programmes for the whole of Switzerland. SFUVET’s activities include the following:

|

Locations | Lausanne, Lugano and Zollikofen |

No. of employees at the end of 2022 | 187 (in FTEs)

|

5.3 Generally accepted accounting principles

The present financial statement was prepared in accordance with the accounting principles set forth in Art. 23 para. 2 of the SFUVET Act, namely materiality, completeness, clarity, consistency and no-netting. It is also compliant with the accounting standards set forth in the Federal Act of 7 October 2005 on the Federal Financial Budget (Financial Budget Act, FBA; SR 611.0; status on 1 January 2022).

Materiality

All information needed for a quick and comprehensive assessment of current assets, finances and earnings should be disclosed.

Completeness

All information must be complete.

Clarity

Information must be clear and comprehensible.

Consistency

Bookkeeping and accounting principles should remain unchanged over an extended period of time, as long as there is no fundamental change in the general conditions.

No-netting

The full amounts of revenue and expenses must be presented separately, without offsetting against each other.

Balancing and valuation

Balancing and valuation principles are determined on the basis of established accounting principles.

Foreign currency

SFUVET’s financial statement for 2022 is presented in Swiss francs (CHF).

Items in foreign currencies are converted to Swiss francs at the closing rate for the transaction in question. Monetary assets and liabilities in foreign currencies are converted to Swiss francs at the closing rate on the balance sheet date, and any exchange differences are reported in the income statement.

Revenue entries

Revenue entries use the date when goods are delivered or services rendered.

If the point in time is a determining factor (e. g. date when a decision is reached or an authorisation is given), then the entry will be based either on the date when the service is rendered or the date when the decision is reached.

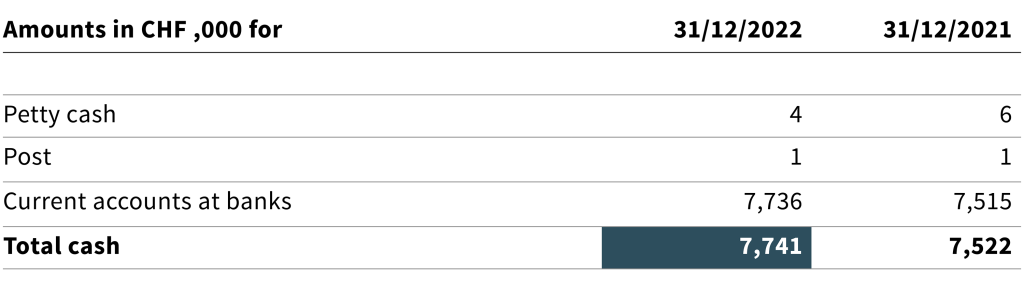

Cash

This includes cash and cash equivalents with a maturity period of 90 days or less (incl. time deposits), which can be readily converted to hard cash at any time. Cash is reported at nominal value.

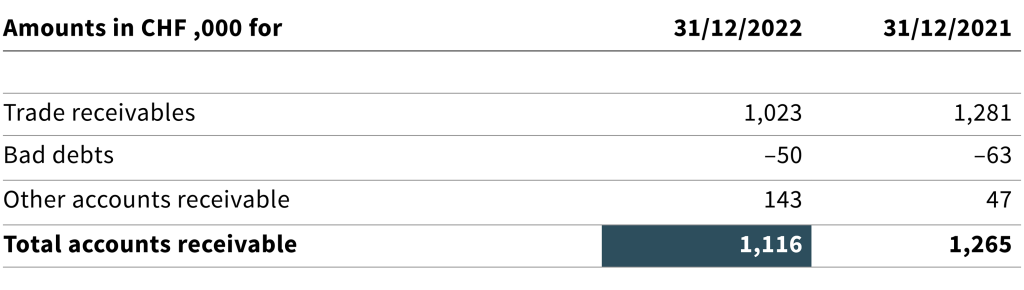

Accounts receivable

The reported amounts correspond to invoiced amounts minus a lump-sum adjustment (for bad debts).

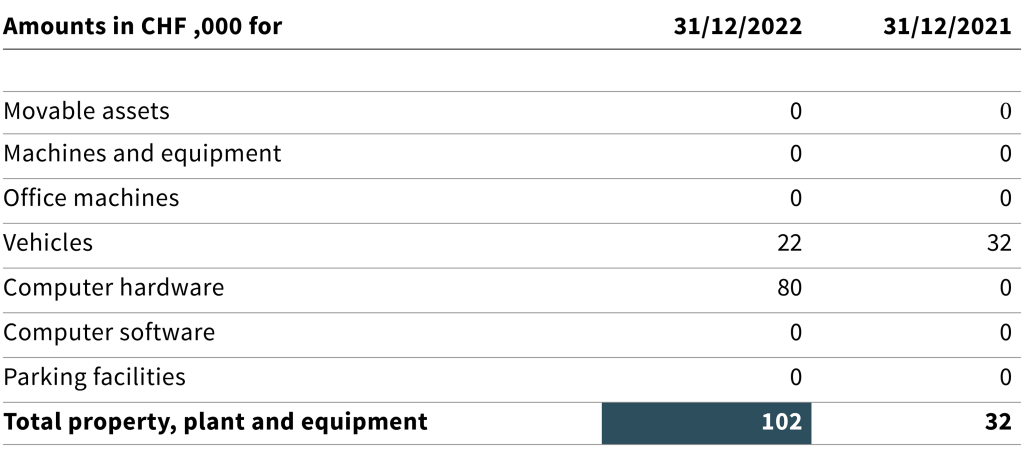

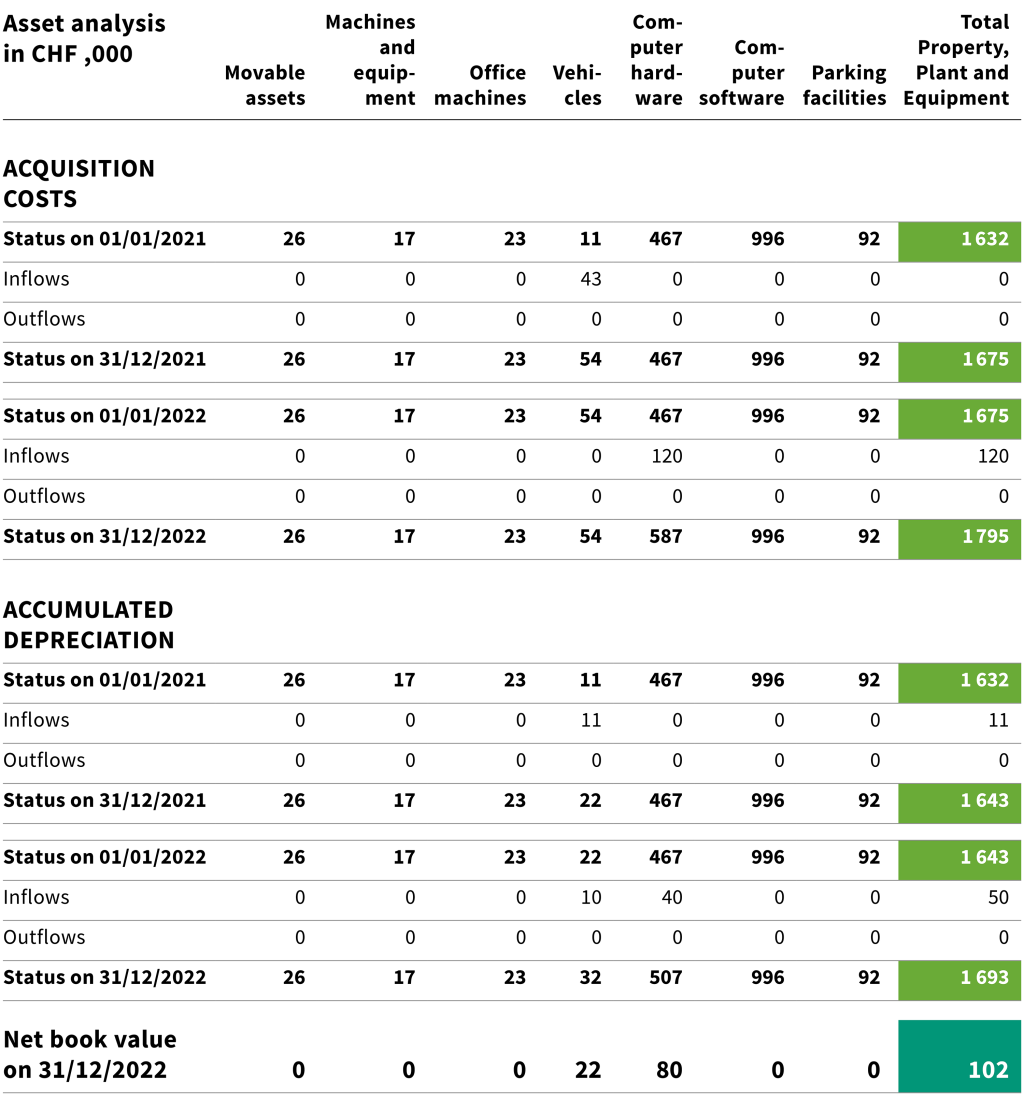

Property, plant and equipment

Property, plant and equipment (PP&E) are valued at the acquisition or production cost and depreciated on the income statement on the basis of the estimated useful life as indicated below:

Land/buildings | None |

Movable assets | 5 years |

Machines and equipment | 5 years |

Office machines | 5 years |

Vehicles | 5 years |

Computer hardware | 3 and 5 years |

Computer software | 3 years |

Fixed assets are reported as property, plant and equipment if the acquisition value exceeds CHF 5000. If the acquisition value is lower, then the fixed assets are directly reported as overhead.

Intangible assets

Computer software is listed as property, plant and equipment (PP&E). Other than this, SFUVET has no other intangible assets

Accounts payable trade

Accounts payable trade are estimated at nominal value.

Provisions

Provisions are established when a past event gives rise to a liability that is likely to cause a drain on resources and when the amount of that liability can be reliably determined. If the drain on resources associated with a given liability is deemed unlikely, then this liability is referred to as a contingent liability.

Provisions have only been established to cover anticipated costs associated with risk events that have already occurred. No provisions have been established for potential risk events in the future.

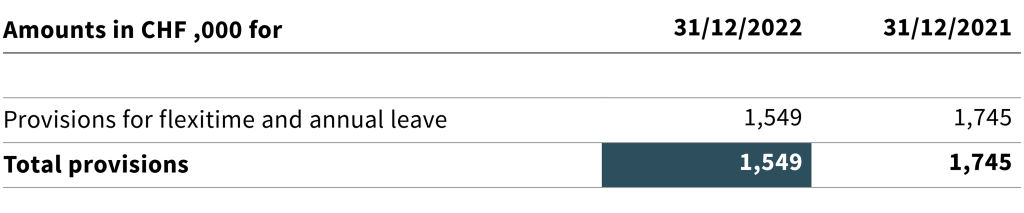

At the end of the year, provisions are established to cover untaken annual leave, untaken days off, unused flexitime, overtime and other time credits.

Equity

According to Art. 24 of the SFUVET Act (SR 412.106), SFUVET may build up reserves, which may not exceed the equivalent of 10% of the operational result reported in the financial statement for the given reporting year.

Reserves are used to offset losses as well as to finance projects and planned capital expenditure.

5.4 Explanations of balance sheet

‘Trade receivables’ include registration fees and tuition for courses offered by the Basic Training Division as well as fees charged by the Continuing Training Division. It also includes services provided by the Continuing Training Division and the Centre for the Development of Occupations as well as ongoing projects carried out by the Research & Development Division. The decrease of CHF 258,000 is mainly due to the fact that fewer services were invoiced in December 2022 than in the same period of the previous reporting year.

The ‘other accounts receivable’ of CHF 143,000 relate to income from the family compensation fund, from third-party funded projects and from the OSI compensation fund.

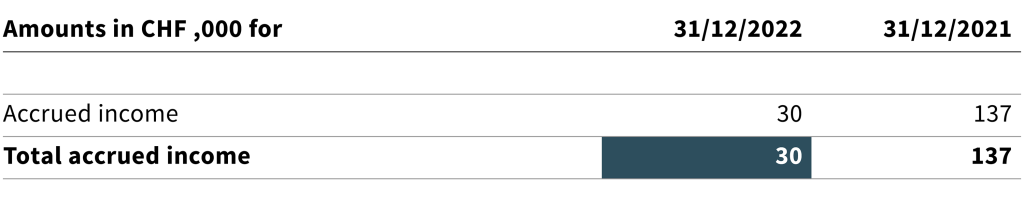

This entry includes services provided in 2022 that will be billed in 2023.

The purchase of assets worth more than CHF 5000 is entered here. The purchase of assets worth less than this amount is directly entered as expenditure.

The increase of CHF 80,000 under ‘computer hardware’ was due to the upgrading of cyber security equipment (firewall).

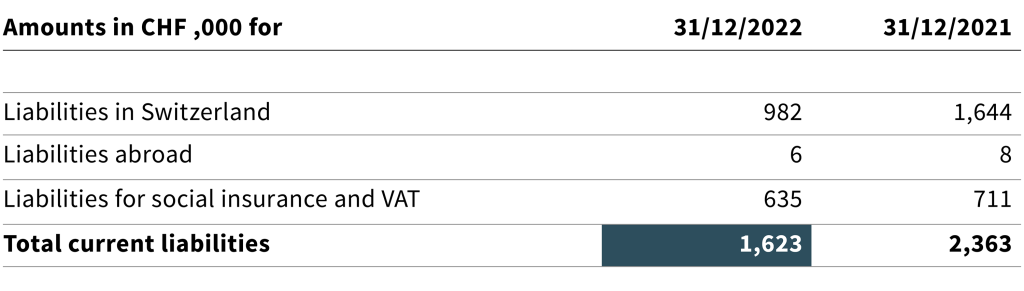

‘Liabilities for social insurance and VAT’ stand at CHF 635,000. This amount also includes payments to the Publica occupational pension fund totalling CHF 533,000 that were paid in January 2023 (2021: CHF 596,000).

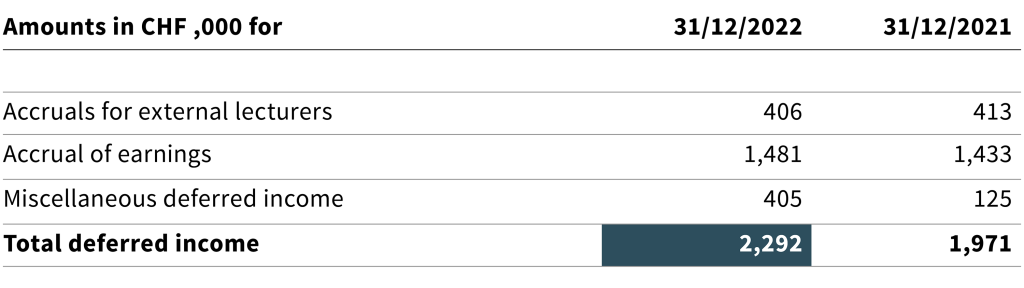

The increase in ‘accrual of earnings’ can be explained by the fact that more invoices were issued in 2022 for work to be done in the following year than was the case in the previous reporting year. The increase in ‘miscellaneous deferred income’ was mainly due to commitments in connection with changes in personnel.

At the end of the year, provisions are made for annual leave, rest days, flexitime hours, over time and other time off (e. g. loyalty bonus) that remained unused by the end of the year. During the reporting year, targeted measures enabled provisions to be reduced by CHF 196,000.

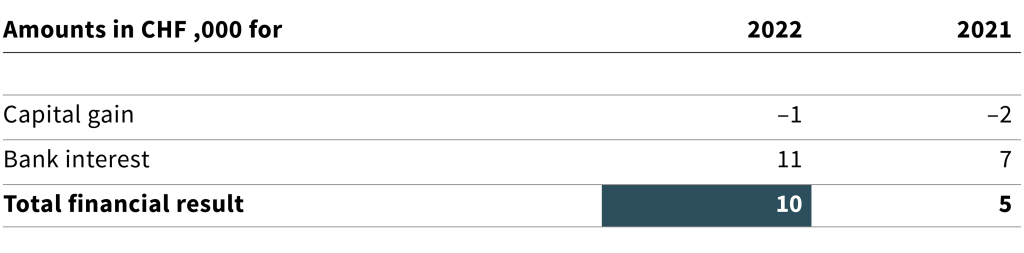

5.5 Explanations of income statement

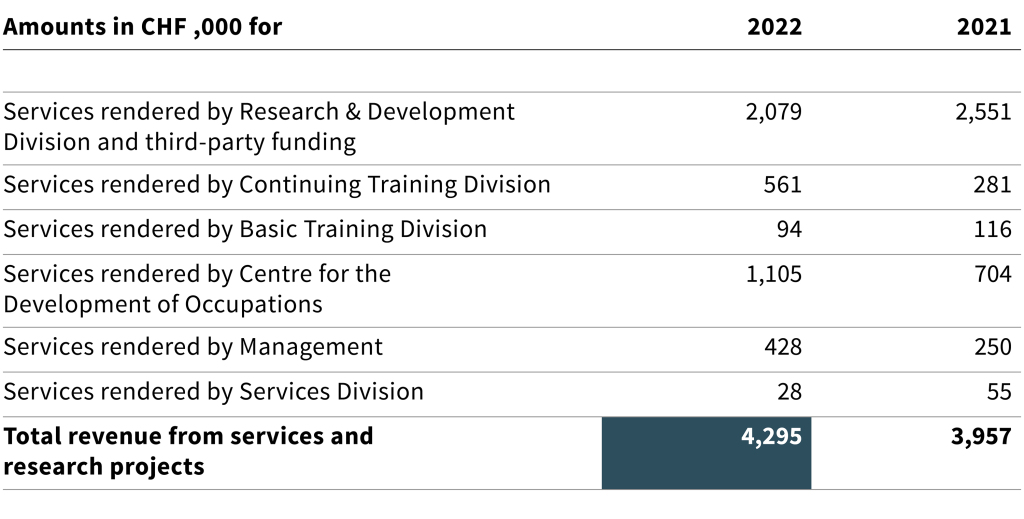

‘Total revenue from services and research projects’ stands at CHF 4,295,000, which constitutes an increase of CHF 338,000 with respect to the previous reporting year. In the Continuing Training division, there was increased demand for tailored courses, which led to increased income. In the Centre for the Development of Occupations, the increase in income came from continuing training courses to facilitate implementation of new VET programmes for retail clerks and commercial employees as well as from new advisory mandates.

The Research & Development Division earned less due to the fact that several major projects came to a close in 2021. The increase in income from services rendered by Management was due to the fact that additional international projects were secured after Covid-19.

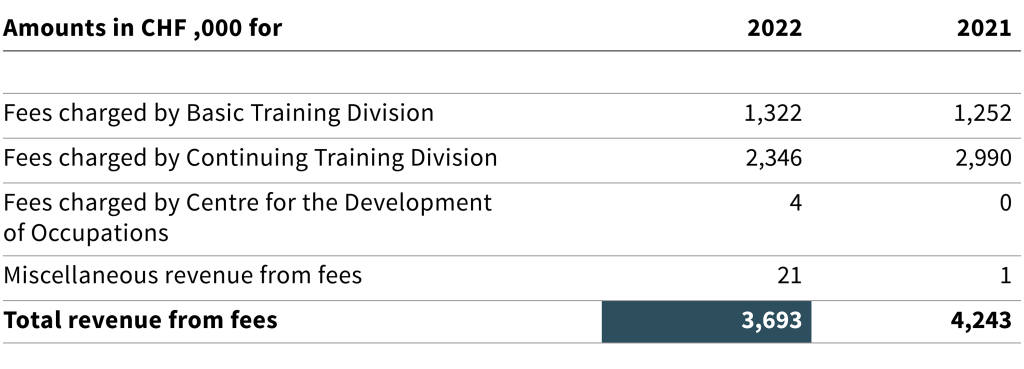

Revenue from fees decreased by CHF 550,000 with respect to the previous reporting year. The decrease in income from the Continuing Training Division was due to falling demand for CAS courses and certificate courses relating to ‘digitalisation’.

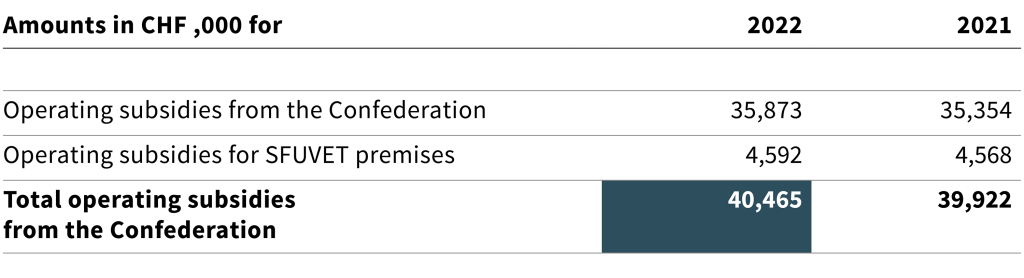

Based on Art. 48 of the Federal Act of 13 December 2002 on Vocational and Professional Education and Training (VPETA, SR 412.10; status on 1 January 2022) and on Art. 19 of the SFUVET Act, the Confederation provides operating subsidies to enable SFUVET to carry out its remit. Under Art. 27 of the SFUVET Act, the Confederation may lease the necessary real estate to SFUVET and when doing so must charge a reasonable lease amount.

The higher ‘operating subsidies from the Confederation’ of CHF 543,000 resulted from the change in budget allocation in relation to the Federal Council Dispatch on the Promotion of Education, Research and Innovation for 2021–2024.

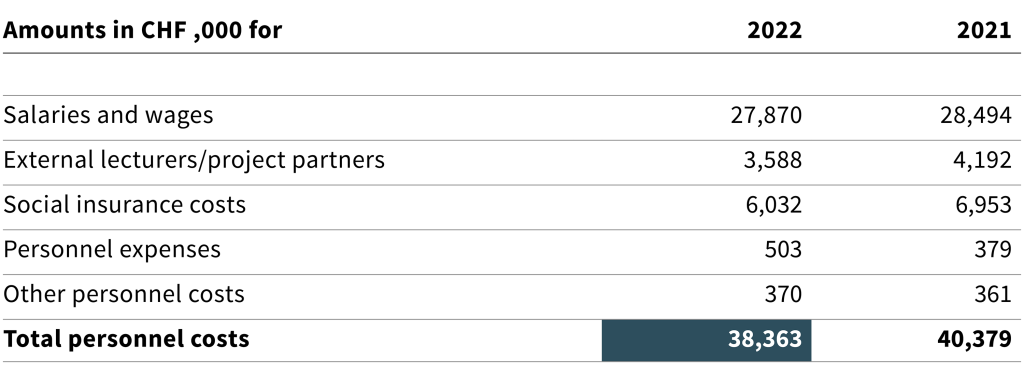

Overall, personnel costs were below the previous year’s level by CHF 2,016,000. The decrease in ‘salaries and wages’ is partly attributable to staff reductions but also to lower accruals for annual leave and flexitime credits. The decrease in costs for ‘external lecturers/project partners’ resulted from decreased income that SFUVET generated from these activities. The lower ‘social insurance costs’ mainly came about because of the reduction in employer’s contribution reserves. The increase in ‘personnel expenses’ is the result of more frequent travelling after Covid-19.

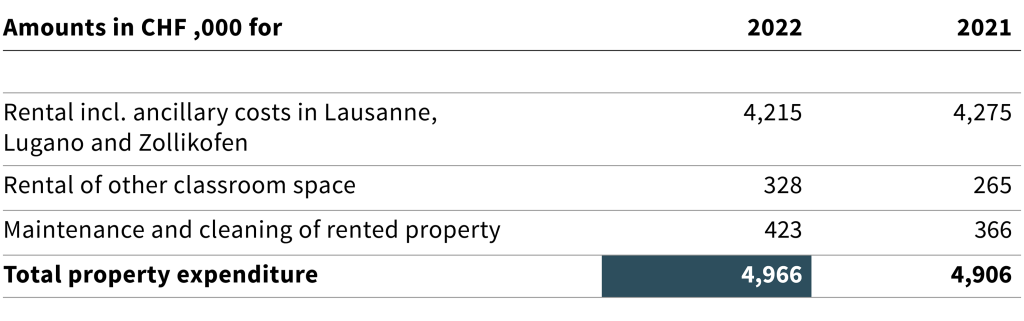

Property expenditure increased by CHF 60,000 compared to the previous reporting year. The lower ‘rental costs incl. ancillary costs in Lausanne, Lugano and Zollikofen’ were possible thanks to refuding of ancillary costs at the Lausanne and Lugano campuses. The higher costs for ‘rental of other classroom space’ were due to more extensive face-to-face classes. The increase in ‘maintenance and cleaning of rented property’ costs resulted from third-party services and renovation work at the Zollikofen campus.

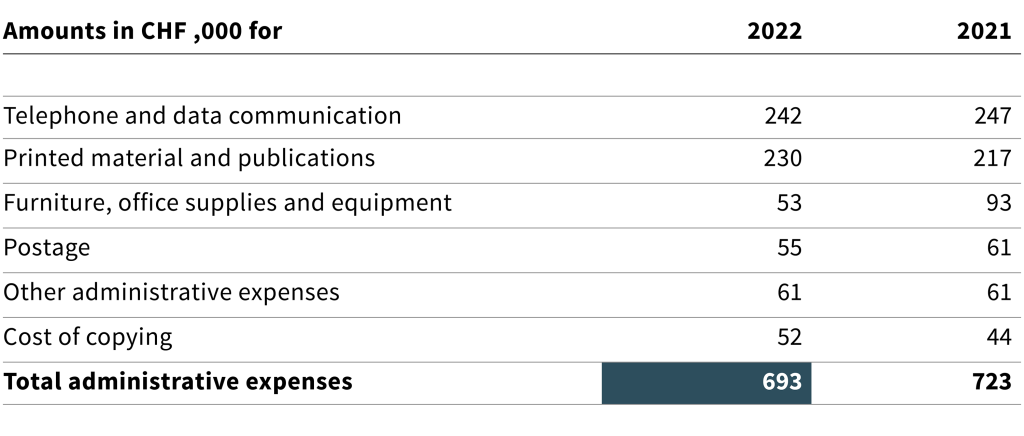

Administrative expenses were CHF 30,000 lower than in the previous year. The position ‘furniture, office supplies and equipment’ was also lower due to decreased furniture costs.

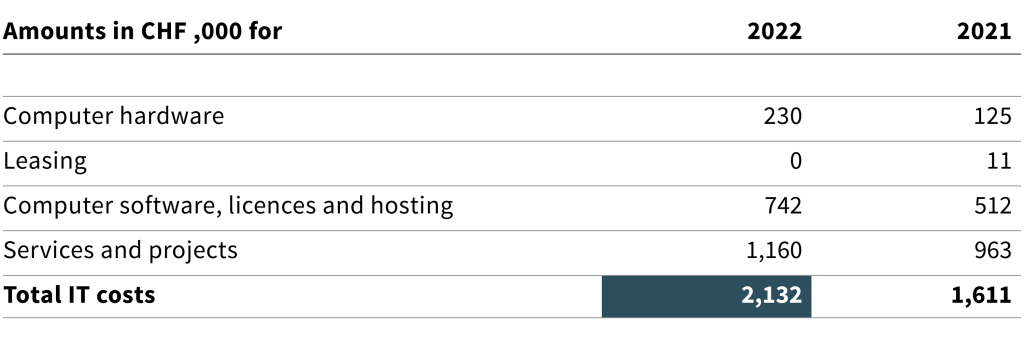

IT costs were CHF 521,000 higher than in the previous year. The higher costs for ‘computer hardware’ were due to upgrading of the WLAN infrastructure on all three campuses. The higher costs for ‘computer software, licenses and hosting’ were due to price increases and the purchase of cyber security software. The additional costs for ‘services and projects’ were mainly due to the fact that SFUVET was unable to fill IT positions, and so operation of the data centre and various applications had to be outsourced to external third parties.

5.6 General comments

Auditing fees (BDO, Bern) in the reporting year amount to CHF 20,000 (previous year: CHF 20,000).

There are no more leasing obligations.

Several liability

SFUVET jointly manages the ‘fordif’ continuing training programme with the University of Geneva, the University of Lausanne and the University of Teacher Education of the Canton of Vaud. In addition, SFUVET, the University of Applied Sciences and Arts of Southern Switzerland (SUPSI) and the University of Ticino (USI) jointly run a CAS course. Several liability may arise as a result of these partnerships.

Events after the balance sheet date

Since the balance sheet date, no events have occurred that would have an impact on the information presented in the financial statement for 2022.

Zollikofen, 9 March 2023

Adrian Wüthrich | Pierre-André Schenkel |